It’s a number that kept going up, with few signs of slowing down.

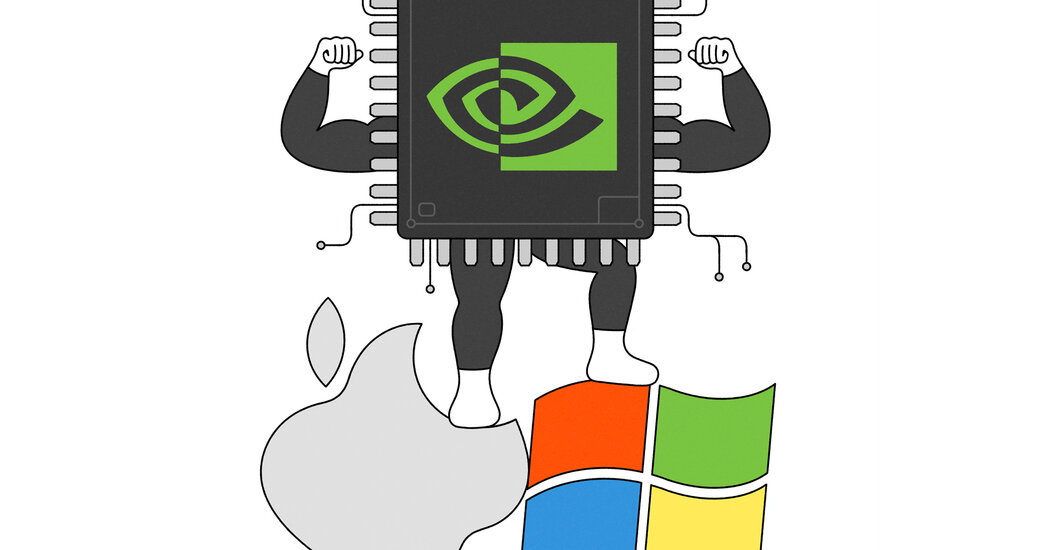

Nvidia, the chip maker, became the most valuable public company on Tuesday with a stock market value of $3.34 trillion. With the close of trading that day, Nvidia’s valuation jumped ahead of Apple’s and Microsoft’s, continuing a meteoric rise that has been aided by the boom of artificial intelligence and, with it, high demand for Nvidia’s chips.

The company was in a good position to take advantage of the current A.I. boom. Jensen Huang, the Nvidia co-founder and chief executive, had predicted that the company’s chips, known as graphics processing units or GPUs, would be essential to the construction of A.I. systems.

Just two years ago, Nvidia was valued at $400 billion; last year, it was $1 trillion. This year, the company hit $2 trillion on March 1, before taking just three months to rise above $3 trillion.

Today, Nvidia controls more than 80 percent of the global market for chips used in A.I. systems, and companies like Amazon, Microsoft and Google are now designing their own chips to become less dependent on Nvidia.

The company’s rapid ascent put it in a rare position: According to data on the S&P 500 going back to the 1920s, only 12 different companies have led the index by market valuation. Nvidia is the 12th. Its growth has been so rapid that some analysts have wondered how long it can last.

“The numbers have gotten so big so quickly,” said Stacy Rasgon, an analyst with Bernstein Research. “If the return on A.I. turns out to not be there, then the whole thing comes crumbling down.”

But Mr. Huang is doubling down on his company’s continued growth.

“We are one year into generative A.I.,” Mr. Huang said in a February interview. “My guess is we are literally into the first year of a 10-year cycle of spreading this technology into every single industry.”